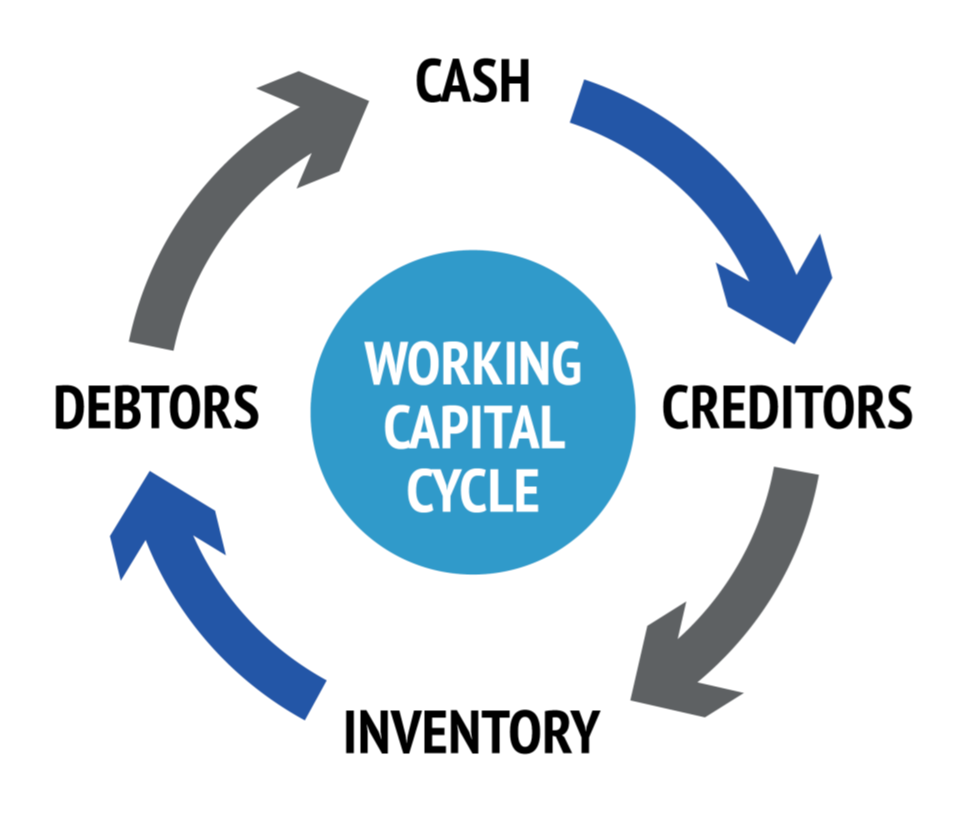

Every small business experiences a regular cash flow cycle, characterized by the inflow and outflow of cash. The timing of these transactions is crucial for maintaining financial stability.

The length and health of a small business's cash flow cycle are influenced by three primary factors:

• Inventory turnover,

• Accounts receivable collection,

• Accounts payable payment terms.

• The inventory turnover ratio measures the efficiency of inventory management.

• A lower value indicates effective inventory control, while a higher value may suggest overstocking or understocking.

• This ratio measures the average time it takes to collect payments from customers.

• A lower value is generally preferable, indicating efficient collections.

• This ratio measures the average time it takes to pay suppliers.

• A higher value can be beneficial as it allows for more flexibility in cash management.

• However, excessive delays can negatively impact supplier relationships.

• Accurate forecasting is essential for effective cash flow management.

• By predicting future cash inflows and outflows, businesses can proactively manage their liquidity.

• Implementing strategies to optimize cash flow, such as improving collection times, negotiating favorable payment terms, and optimizing inventory levels, can significantly enhance financial performance.

• Regular analysis of cash flow statements can provide valuable insights into a business's financial health and identify areas for improvement.

By effectively managing cash flow, businesses can mitigate risks, seize opportunities, and achieve long-term financial success.