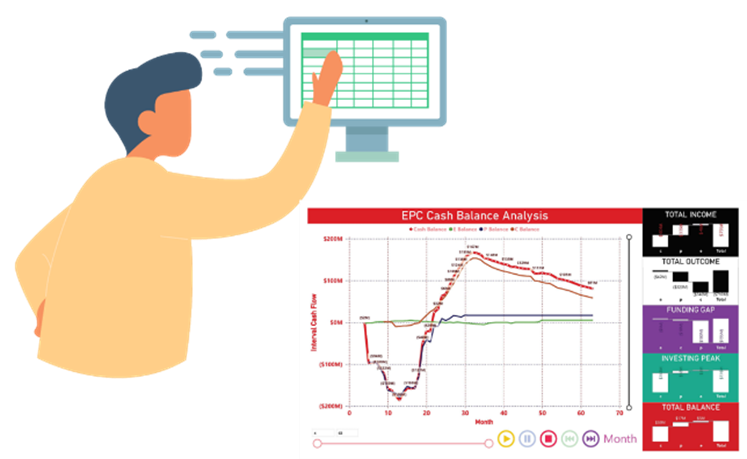

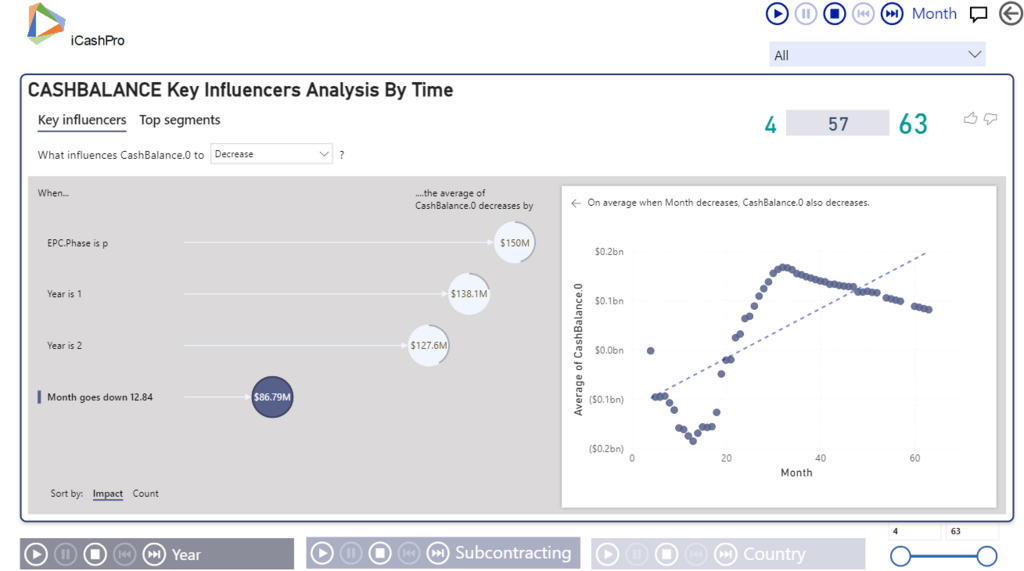

Intelligent Cash Planning and Analysis (ICP&A) is a dynamic dashboard with actionable insight to analyze a company's future financial health through data maturity mathematical modeling of receivables and payments networks to support a company's most critical business decisions.

To create a solid cash flow model, we need a deep understanding of:

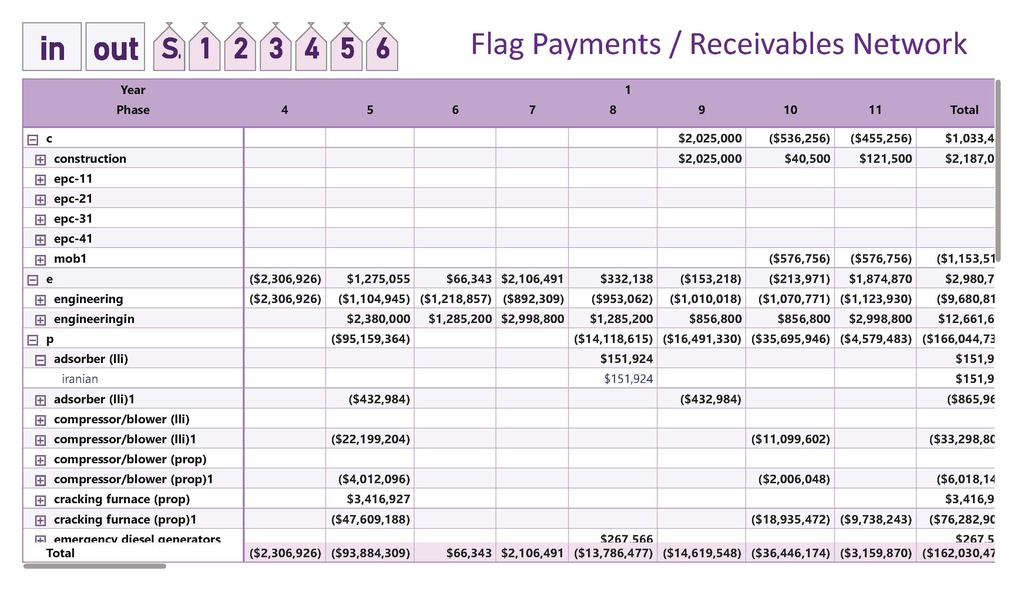

The cash flow model should account for different payment methods, such as:

Cash flow analysis is crucial for effective project management. It helps us understand:

We can use various techniques to analyze cash flow, including:

Due to inherent uncertainties and risks, cash flow models must be flexible and adaptable.

We can use expert judgment and risk analysis techniques to improve the accuracy of our forecasts.

Cash Flow: The movement of money into and out of a business.

Financial Model: A quantitative representation of a business's financial performance.

Stakeholders: Individuals or groups with an interest in a business or project.

Macro-environmental Factors: Broad economic, social, political, and technological factors.

Micro-environmental Factors: Factors specific to the industry and market.

Execution Plan: A detailed plan for carrying out a project.

Cost Estimation: The process of estimating the cost of a project.

Implementation Strategy: A plan for how to implement a project.

Outsourcing: Hiring a third-party to perform a task.

Pre-payments: Payments made in advance.

Stage Payments: Payments made at specific stages of a project.

Post-payments: Payments made after the work is completed.

Accrual Payments: Payments for expenses that have been incurred but not yet paid.

What-if Scenario Analysis: Analyzing different possible outcomes.

Sensitivity Analysis: Analyzing how sensitive a model is to changes in input variables.

Lifecycle Analysis: Analyzing the cash flow over the entire life of a project.

KPIs: Key Performance Indicators.

Risk Analysis: Identifying and assessing potential risks.