Cash flow is the lifeblood of any business, making effective management crucial for financial health and long-term success.

Scenario planning is a powerful tool that helps businesses anticipate future events, assess potential risks, and make informed decisions.

By utilizing cash flow scenario analysis, organizations can gain valuable insights into their financial future and proactively optimize their cash position.

In today’s dynamic business environment, organizations face numerous uncertainties.

Scenario planning allows businesses to evaluate potential outcomes across a range of financial scenarios, identify inherent risks, and make strategic decisions.

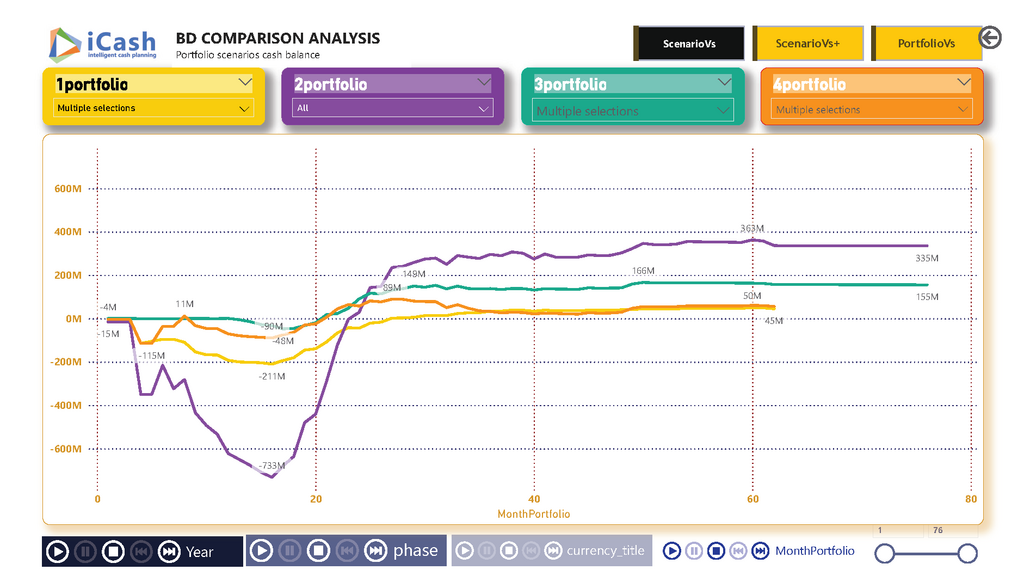

iCashPro streamlines this process, enabling the effortless creation and comparison of various financial scenarios, ultimately enhancing robust financial planning.

Cash flow scenarios are hypothetical representations of future cash inflows and outflows. These scenarios are constructed by varying key assumptions, such as:

• Sales income

• Operating expenses

• Strategies

• Environmental factors

• Terms of payments

• Financing activities

• Investing activities

By analyzing multiple scenarios, businesses can assess the impact of different events on their cash flow and identify potential risks and opportunities.

Cash flow scenario analysis is pivotal for effective cash planning and decision-making. Understanding various cash flow scenarios allows organizations to:

• Identify Risks: Explore different scenarios to uncover potential risks, such as unexpected expenses or economic downturns. Early identification facilitates proactive risk mitigation strategies.

• Support Decision-Making: Gain insights that help evaluate the financial implications of strategic choices, including new product launches, acquisitions, or expansion plans.

• Enhance Financial Planning: Develop robust financial plans that can withstand diverse economic conditions by understanding the potential impact of various scenarios.

• Manage Liquidity: Assess liquidity positions to identify potential cash shortages or surpluses, enabling proactive liquidity management to ensure sufficient funds are available to meet obligations.

iCashPro empowers businesses to conduct comprehensive cash flow scenario analysis with ease. Key features and benefits include:

• Scenario Creation: Easily create multiple scenarios by adjusting key assumptions, such as sales forecasts and cost structures.

• Sensitivity Analysis: Assess how changes in specific variables affect cash flow, helping identify critical factors that drive financial performance.

• Comparative Analysis: Compare the financial performance of different scenarios side-by-side to identify strengths, weaknesses, and potential risks.

• Visualizations: Utilize clear visualizations, such as charts and graphs, to understand complex financial data and trends.

• Proactive Planning: Identify potential cash flow bottlenecks and develop strategies to optimize cash flow and mitigate risks.

With iCashPro's scenario planning capabilities, businesses can achieve a holistic view of their cash position. By analyzing various scenarios, organizations can pinpoint risks and opportunities, as well as identify areas for improvement.

This proactive approach to liquidity management supports informed decisions regarding investments, financing, and overall business development.

Cash flow scenario analysis can be applied to various business situations, including:

• Strategic Planning: Evaluate the financial implications of long-term initiatives, such as mergers and acquisitions or new market entry.

• Capital Budgeting: Assess the financial viability of capital investment projects, such as plant expansions or equipment purchases.

• Financial Forecasting: Develop accurate forecasts by considering a range of potential outcomes.

• Risk Management: Identify and mitigate financial risks, such as credit risk, market risk, and operational risk.

• Crisis Management: Develop contingency plans to address potential financial crises, such as economic downturns or supply chain disruptions.

By effectively utilizing cash flow scenario analysis with iCashPro, businesses can gain a competitive edge, make informed decisions, and achieve long-term financial success.

Cash flow scenario analysis involves assessing the likely outcomes of different cash flow situations. One effective method is sensitivity analysis, where key variables are adjusted to observe their impact on cash flow.

This technique helps identify potential risks, evaluate various strategies, and refine financial plans. Understanding how changes in sales volume, pricing, or operating costs influence cash flow enables organizations to navigate challenges with greater agility.

Proactive Measures for Cash Management

Using iCashPro to create and compare cash flow scenarios allows businesses to identify potential cash shortages or surpluses in advance. This foresight enables proactive measures to mitigate risks, ensuring financial stability.

Efficient resource allocation becomes possible, directing funds to areas that promise the highest returns.

Beyond immediate cash flow management, scenario analysis is crucial for assessing the feasibility of new projects and understanding the implications of changes in market conditions or pricing strategies. By developing comprehensive contingency plans based on various scenarios, organizations can remain resilient in the face of unexpected challenges.

Conclusion

In summary, scenario analysis through iCashPro equips organizations with essential tools for comprehensive financial planning. By examining multiple cash flow scenarios, businesses can identify risks, seize opportunities, and make strategic decisions that foster growth and sustainability. Embracing this analytical approach enhances financial health and positions organizations for long-term success in a rapidly changing market.

• Cash Flow: The total amount of money being transferred in and out of a business.

• Scenario Planning: A strategic method used to make flexible long-term plans based on the analysis of various potential future events.

• Sensitivity Analysis: A financial model technique used to predict the outcome of a decision given a certain range of variables.

• Liquidity Management: The process of managing the cash flow and ensuring that a business has enough cash to meet its obligations.

• Capital Budgeting: The process of planning and managing a firm's long-term investments.

• Risk Mitigation: Strategies to reduce or eliminate the impact of potential risks on an organization.

• Contingency Plans: Backup plans that outline alternative courses of action in case of unforeseen events or emergencies.