• Cash flow is a vital indicator of a company's financial health. Effective cash flow management is essential for business success and sustainability. A scarcity of resources, often manifested as a cash shortage, can pose significant challenges for organizations.

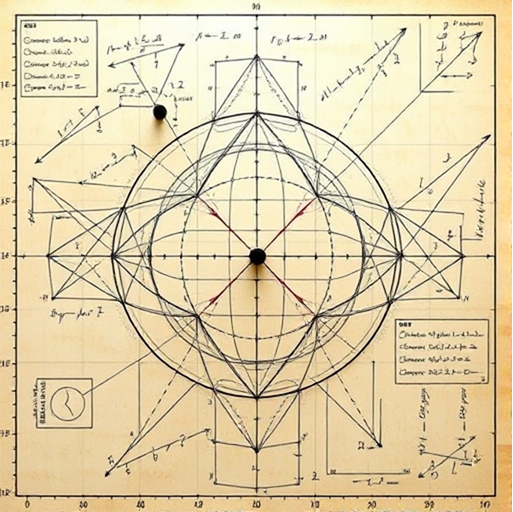

• A mathematical model, developed through the application of business intelligence and cash planning expertise, offers a structured approach to understanding complex financial and economic processes. By simulating future cash flows through the aggregation of payments and receipts, this model enables organizations to predict cash balances and identify potential risks.

• In large, project-oriented organizations, managerial authority and decision-making play a crucial role in determining business success. Effective decision-making necessitates accurate metrics and indicators.

• Interdepartmental conflicts often arise during project decision-making processes, with contractual agreements ultimately determining cash inflows and outflows. Consequently, cash flow management emerges as a pivotal factor in organizational success.

• An IPC Petroleum project where the contractor's insufficient funding capabilities hindered the project team's ambitious goals, ultimately leading to business failure. Numerous cases across various industries demonstrate the detrimental impact of neglecting cash flow planning, often resulting in project abandonment or business failure.